Conservative Senedd members warned "ill thought out and unnecessary" plans for a tourism tax will make people think twice about holidaying in Wales.

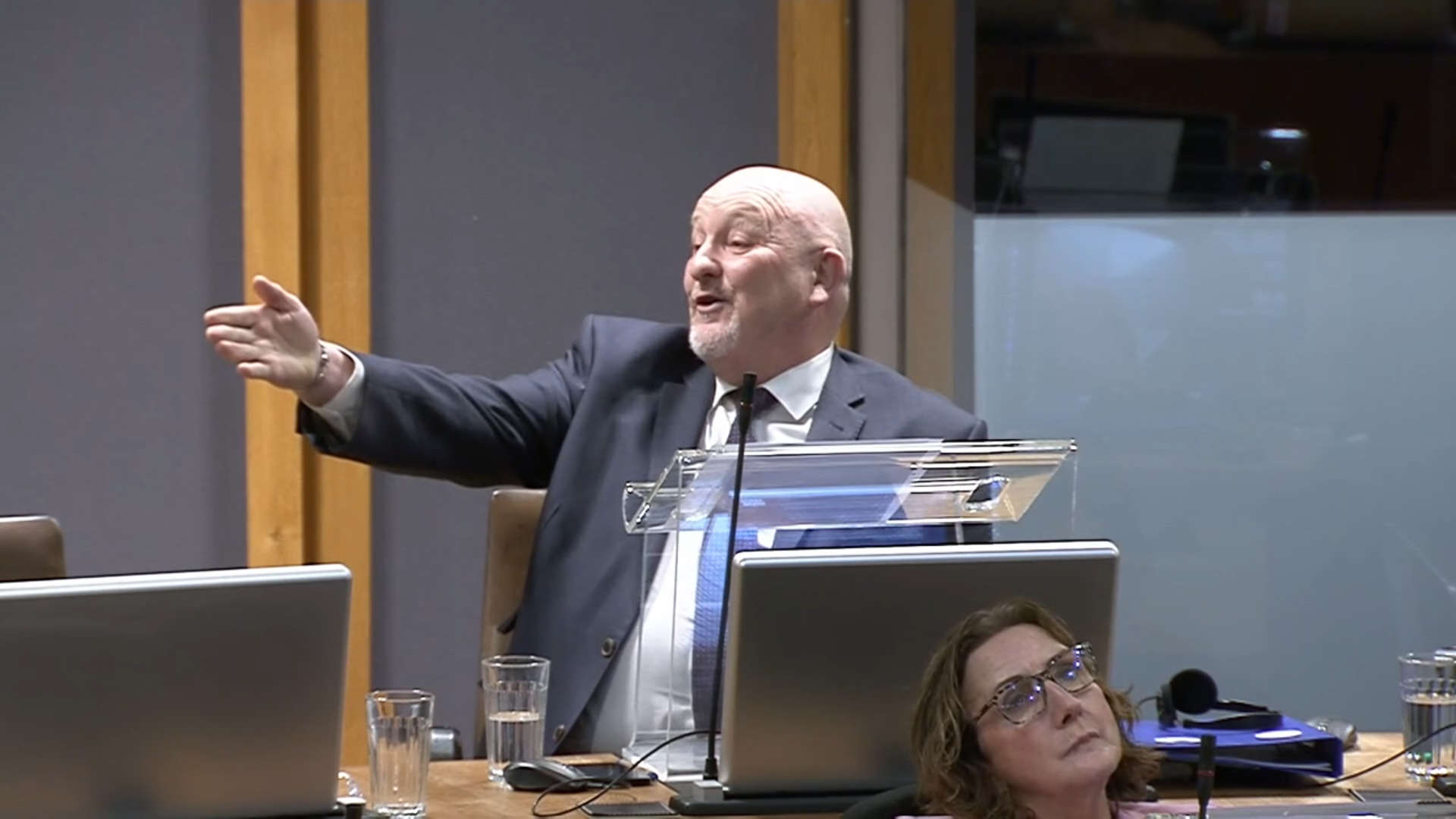

Peter Fox raised concerns about visitors being priced out after the Welsh Government unveiled a tourism bill, which would give councils powers to charge for overnight stays.

Mr Fox told the Senedd: "This is an industry that should be supported, not exploited," with one in seven jobs in Wales relying on tourism, equating to almost 200,000 people.

The Tories' shadow finance secretary warned the tax could cost hundreds of jobs, with the hospitality sector already paying double the business rates of counterparts in England.

He said the tourism industry is still rebuilding from the pandemic, warning: "The legislation will create another significant pressure on an incredibly hard-pressed sector."

'Anti-tourism'

Mr Fox, who represents Monmouth, raised concerns about the "hidden" costs of bureaucracy under the bill which would also introduce a register of tourism providers.

He rejected the depiction of £1.25 per person per night as minimal, saying a family with four children would have to budget an extra £50 to £60 for a week's stay.

His Conservative colleague Darren Millar said he was angry on behalf of businesses when the tourism tax, which would raise up to £33m a year from 2027, was first mooted in 2017.

Warning tourists will go to the north-west coast of England, he said: "We know that visitors who come to places like Rhyl, Colwyn Bay, Llandudno – many of them are price-sensitive."

The Clwyd West Senedd member blamed the Welsh Government's "anti-tourism" messaging for a fall in last year's visitor numbers, which were down 14% on 2019.

'Remortgage your house'

But Luke Fletcher welcomed the tourism bill, which was a commitment in the now-collapsed cooperation agreement between Plaid Cymru and the Welsh Government.

He said: "If you had listened to what some have said...you'd swear that in order to visit Wales you'd have to remortgage your house because it would be so expensive. That simply isn't the case, is it?"

Mr Fletcher, who represents South Wales West, described £1.25 a night as reasonable, pointing to a lower rate of 75p for stays at hostels and camp sites.

Mike Hedges, a Labour backbencher, said visitor levies are common across Europe, with more than 60 places around the world having similar taxes.

He asked: "Why would a visitor levy affect Wales when it does not affect Spain, Greece or France – the three most visited destinations in Europe?"

'Fairness'

In a statement on Tuesday, Mark Drakeford stressed the levy is rooted in fairness, with tourists being asked to make a "small" contribution to public services.

The finance secretary said: "Many Senedd members here today will have paid a levy abroad, probably without noticing perhaps. Governments worldwide recognise that visitor levies are an effective means to offset some of the costs associated with tourism."

Pointing to charges in Manchester and similar legislation passed in Scotland this year, the ex-first minister said: "Our proposals in Wales are rowing with the tide, not against it."

He criticised opposition attempts to "catastrophise what is a modest measure".

Closing his statement, Mr Drakeford told the Senedd: "This is a step closer towards a fairer, more sustainable Wales where the benefits and responsibilities of tourism are shared by all."

'No plans'

Two years ago, when the plans were first mooted by the Welsh Government, the leader of Vale Council ruled out introducing a tourism tax locally.

The Visitor Accommodation Bill, published on Monday, set out proposals to give local authorities the power to introduce the overnight levies in their areas.

But Cllr Lis Burnett told the Local Democracy Reporting Service in September 2022: "The council has no plans to introduce a tourism levy in the Vale of Glamorgan."

“We understand that the proposal is to give discretion to councils as to whether they do and we are not minded to at the moment.”

Under the proposals, the tax could be introduced in some areas of Wales as early as 2027.

Additional reporting by the Bro Radio Newsroom

Vale line closes for engineering works

Vale line closes for engineering works

Freedom of the Vale for RNLI volunteers

Freedom of the Vale for RNLI volunteers

Senedd moving out of Siambr

Senedd moving out of Siambr

Norovirus: hospital pressure 'exceptional'

Norovirus: hospital pressure 'exceptional'

Morgan grilled over £4.8bn benefit cuts

Morgan grilled over £4.8bn benefit cuts

Barry Bike Club to return

Barry Bike Club to return

St David bravery award for Penarth lifesaver

St David bravery award for Penarth lifesaver

Ruth Jones honoured with St David Award

Ruth Jones honoured with St David Award

Plans for ‘crumbling’ Senedd offices face scrutiny

Plans for ‘crumbling’ Senedd offices face scrutiny

Work to start on new Vale campuses

Work to start on new Vale campuses

Barry Company launches world's first edible soap

Barry Company launches world's first edible soap

First Minister visits Barry Makerspace

First Minister visits Barry Makerspace

Council's housing waiting list grows again

Council's housing waiting list grows again

Cardiff Airport's chief exeuctive quits

Cardiff Airport's chief exeuctive quits

Norovirus: hospital visitor ban extended

Norovirus: hospital visitor ban extended

Littering on the increase, charity warns

Littering on the increase, charity warns

Hot Chicks – 'powerfully performed yet disappointingly stereotypical'

Hot Chicks – 'powerfully performed yet disappointingly stereotypical'

Unhealthy meal deal ban passes by one vote

Unhealthy meal deal ban passes by one vote